by Ron Lewarchik and Vishakha Makode

Architectural coatings are not “just paint” anymore. They are now strategic materials that influence how buildings breathe, last, and even contribute to sustainability goals. The market is shifting fast, not just by choice, but because regulation, customer preferences, and performance demands are driving the change. This article will concentrate primarily on waterborne ambient cure technologies used primarily in interior and exterior applications on residential as well as some commercial applications. For more on Architectural coatings that are coil applied and/or other baked finishes, please see the Prospector article on Architectural coatings dated October 2, 2024.

We’ve lived through this technology revolution in different ways. From the long days of trying to formulate a zero-VOC waterborne formulation that didn’t flow and level; or trying to develop a zero VOC architectural finish to ensure adequate cure speed when using zero VOC ingredients that do not have a deleterious effect on cure speed.

Formulators have proven that sustainability doesn’t have to mean compromise, and performance doesn’t mean high VOCs. The global market is demanding this balance. And it’s time the industry treated coatings not as commodities, but as critical technologies for a new era of construction and meeting the changing demands of the industry.

This article highlights where innovation is taking place with resins, pigments and fillers, additives, and testing methodology. It also examines how market priorities vary across North America, Europe, and Asia-Pacific.

The Market Reality

The global architectural coatings market is about USD 83–92 billion in 2025 and is heading toward USD 125–135 billion by 2032–2035. The CAGR looks boring on paper (4–6 %), but when you’re inside the industry, you feel the pressure of having more SKUs, more compliance, more sustainability expectations. In the US it is projected that 45.7% of all paints sold in 2025 are waterborne, with a higher percentage of those used in ambient cure waterborne coatings being even higher.

Growth drivers are clear:

- Urbanization in Asia

- Renovation cycles in North America and Europe

- Premium quality is desired by consumers as they are willing to pay for healthier, longer-lasting finishes or meet environmental compliance.

But the challenge is also clear, how to deliver performance + sustainability + affordability all at once?

Technical Innovations

Resins & Binders

Resins form the backbone of architectural paints and define film formation, durability, and compatibility with other components. Advances in resin chemistry are central to next-generation coatings.

- Acrylics and self-crosslinking acrylics:

- Conventional acrylic emulsions remain the workhorse in interior and exterior paints.

- Self-crosslinking acrylics use pendant reactive groups (such as carbamate, acetoacetoxy, or silane functionalities) that undergo crosslinking during film formation. This enhances block resistance, hardness, and scrub resistance without adding VOCs.

- Waterborne alkyd emulsions:

- Alkyd resins emulsified in water combine the gloss, flow, and penetration of traditional solvent-based alkyds with reduced VOC levels.

- Often stabilized with surfactants or grafted with acrylic segments for improved stability and drying.

- Polyurethane dispersions (PUDs):

- Based on aliphatic or aromatic isocyanates reacted with polyols, then dispersed in water.

- Known for toughness, abrasion resistance, and chemical resistance, making them suitable for high-traffic interior walls and flooring applications.

- Styrene-acrylic copolymers:

- Incorporate styrene for improved hardness, alkali resistance, and cost efficiency.

- Widely used in exterior paints where chalk resistance and durability are important.

- Silicone-modified resins:

- Incorporate siloxane chains or silane groups that reduce surface energy.

- Provide water repellency, dirt pickup resistance, and “self-cleaning” effects for exterior walls.

- Vinyl acetate-based systems (PVA and VAE):

- Polyvinyl acetate (PVA) emulsions are economical for interior flat paints.

- Vinyl acetate–ethylene (VAE) copolymers improve flexibility and adhesion, extending their utility in architectural coatings.

- Bio-based resins:

- Derived from renewable resources such as soy oil, castor oil, or lignin.

- Functionalized fatty acid derivatives are used to create alkyd-like binders, while lignin is being investigated as a replacement for phenolic and styrene monomers.

- Hybrid systems:

- Combinations such as acrylic–alkyd and acrylic–silicone balance cost, gloss, hydrophobicity, and application performance.

- Increasingly common in mid-tier coatings where both sustainability and durability are expected.

Pigments & Fillers

Pigments and fillers define the optical properties, durability, and economics of architectural coatings. Advances in pigment engineering and filler technology are enabling both performance and sustainability gains.

- Titanium dioxide (TiO₂):

- The primary white pigment used in architectural paints is available in rutile and anatase forms.

- Rutile TiO₂, often surface-treated with alumina and/or silica, provides superior hiding power, weathering resistance, and chalk resistance.

- Optimized dispersion using polycarboxylate-based dispersants or engineered extenders improves TiO₂ spacing, enabling 10–20% reduction in loading without compromising opacity.

- Colored inorganic pigments:

- Iron oxides (red, yellow, black) are widely used for durability and UV stability.

- Chromium oxide green, ultramarine blue, cobalt blue offer excellent exterior durability, lightfastness and chemical resistance, but are not as vibrant as some organic pigments.

- For more demanding applications such as monumental buildings or roof applications, applied by coil coating, quite often use such ceramic pigments for long term warranty applications.

- Functional coatings often include doped mixed-metal oxides for infrared (IR) reflectivity, reducing heat buildup on exterior walls by 5–10 °C.

- Organic pigments:

- High-chroma organic pigments such as phthalocyanine blues and greens, quinacridones, and azo pigments provide vibrant shades.

- While less durable and chemically resistant than inorganic pigments, encapsulation and surface treatments are improving their Weatherability.

- Functional pigments:

- IR-reflective pigments (e.g., doped titanium oxides, complex inorganic color pigments) reduce solar heat gain.

- UV-blocking pigments (nano zinc oxide, cerium oxide) extend coating life by minimizing polymer degradation.

- Fillers and extenders:

- Calcium carbonate is the most common extender, providing bulk and reducing cost.

- Talc and kaolin clay modify rheology and improve barrier properties.

- Aluminosilicates (natural or synthetic) enhance scrub resistance and matting.

- Lightweight hollow microspheres (glass/ceramic or polymeric) reduce density, improve thermal insulation, and control film build.

- Nanoparticle additives:

- Nano-silica improves abrasion and burnish resistance.

- Nano-alumina enhances hardness and scrub performance.

- Zinc oxide nanoparticles can act as antimicrobial agents while providing UV shielding.

- Engineered mineral extenders:

- Tailored particle morphology and surface treatments regulate oil absorption, viscosity, and film integrity.

- Advances in surface modification allow fillers to better interact with resins, reducing demand for TiO₂ while maintaining opacity.

- Sustainable filler approaches:

- Industrial by-products (engineered mineral streams) are increasingly replacing mined fillers.

- Proper beneficiation ensures consistency in particle size, whiteness index, and chemical stability.

- Sustainable fillers not only reduce raw material cost by up to 20–30% but can lower the embodied CO₂ of paint formulations by as much as 40%

Work smarter and win more, with powerful software to manage regulatory, supply chain and sustainability challenges, learn more about ULTRUS here!

Additives

Although additives often account for less than 5% of a formulation, they largely determine how a coating applies, levels, resists defects, and performs over time. Their chemistries are highly specialized and targeted.

- VOC-free coalescents for waterborne paints:

Traditional coalescents such as Texanol (2,2,4-trimethyl-1,3-pentanediol monoisobutyrate) are effective but contribute to VOC content. Modern alternatives include reactive diols, adipate esters, and low-volatility polyols that participate in the film network rather than evaporating. Examples include 2-methyl-1,3-propanediol and certain dibasic ester blends. - Moisture scavengers (for use in two component urethanes and other moisture sensitive systems)

Silane-based additives such as vinyltrimethoxysilane and aminosilanes react with free water, reducing blistering and improving storage stability. Zeolite- or molecular sieve–based additives are also being explored for water-sensitive systems. - Antimicrobials:

Protection against microbial growth is achieved using isothiazolinones (e.g., 1,2-benzisothiazolin-3-one, BIT), IPBC (iodopropynyl butylcarbamate), or zinc oxide nanoparticles. Regulatory restrictions in Europe are driving innovation toward safer and longer-lasting non-leaching solutions. - Rheology modifier (for waterborne paints):

- HEUR (Hydrophobically Modified Ethoxylated Urethane) thickeners are valued for excellent flow and spray application.

- HASE (Hydrophobically Modified Alkali-Swellable Emulsion) thickeners provide sag resistance and structure for high-built systems.

- PU associative thickeners (PUATs) balance open time, leveling, and application properties in premium paints.

- Surface-active agents:

Polysiloxane surfactants lower surface tension, improving wetting and flow. Fluoropolymer-based surfactants enhance stain repellency and ease of cleaning, though their regulatory status requires close monitoring. - Defoamers:

Common classes include silicone-based (polydimethylsiloxane) and mineral oil–based systems. Silicone-modified polyether defoamers offer a balance between defoaming efficiency and compatibility in waterborne coatings.

VOC Reduction and Testing

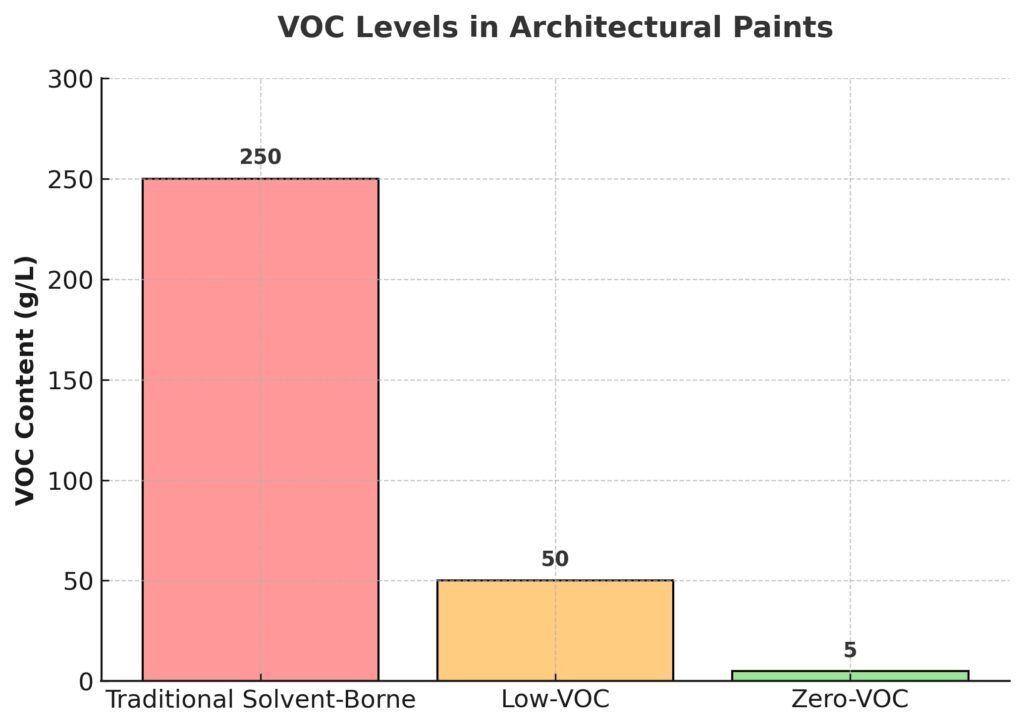

When people refer to “green paints,” the first question is what’s the VOC content? For architectural coatings, this isn’t just a marketing claim, it’s a regulated parameter that determines whether a product can even be sold in certain regions.

In North America, the reference point is EPA Method 24 and ASTM D3960, which measure VOC by calculating the volatile fraction of the coating. California’s CARB rules are even stricter, with limits of 50 g/L for flats and 100 g/L for non-flats. In Europe, the Decopaint Directive sets maximum thresholds across multiple paint categories, while Asia-Pacific countries like China and India are gradually aligning with these global benchmarks.(please reference our UL Prospector article in the September 8, 2025 issue)

Testing isn’t just about numbers on paper. Techniques like gas chromatography (ASTM D6886) allow formulators to see which solvents are actually present, while ISO 16000 chamber tests measure real indoor emissions after a paint is applied. This makes a big difference when coatings are marketed for “healthy homes” or school and hospital interiors.

On the formulation side, the strategy has shifted from traditional coalescents like Texanol toward reactive diols, dibasic esters, and low-volatility polyols. These don’t just evaporate, depending on the resin technology used, they become part of the polymer network. Pair that with lower-MFFT binders and multifunctional additives, and suddenly a paint can perform well without relying on high VOC stabilizers.

Sustainability Testing and Validation

Sustainability in coatings is no longer just about being “low-VOC.” The conversation has broadened to include raw material sourcing, embodied energy, recyclability, and carbon footprint. In other words, what happens before and after the paint is applied is just as important as how it performs on the substrate.

The most structured way to measure this is through a Life Cycle Assessment (ISO 14040/44). This takes a comprehensive look at the paint system: energy used to produce the resin, emissions during application, and even disposal of leftover paint. A more focused approach is carbon footprint analysis (ISO 14067), which expresses the greenhouse gas emissions per liter of paint.

Eco-labels have made these frameworks more visible. For example, the EU Ecolabel, Green Seal, and LEED v4.1 credits are all tied back to VOC levels, raw material transparency, and overall sustainability. Increasingly, large buyers like governments, schools, housing authorities won’t even consider a product without such certifications.

Fillers are a good case study., for example conventional calcium carbonate and talc are effective but carry a higher embodied CO₂ due to mining and processing. By contrast, engineered mineral by-products can cut the carbon footprint by 30–40% while also lowering cost. The trick is consistency: whiteness index (ISO 2469), oil absorption (ASTM D281), and stability tests are all needed to prove that these fillers can perform at scale.

Regional Insights

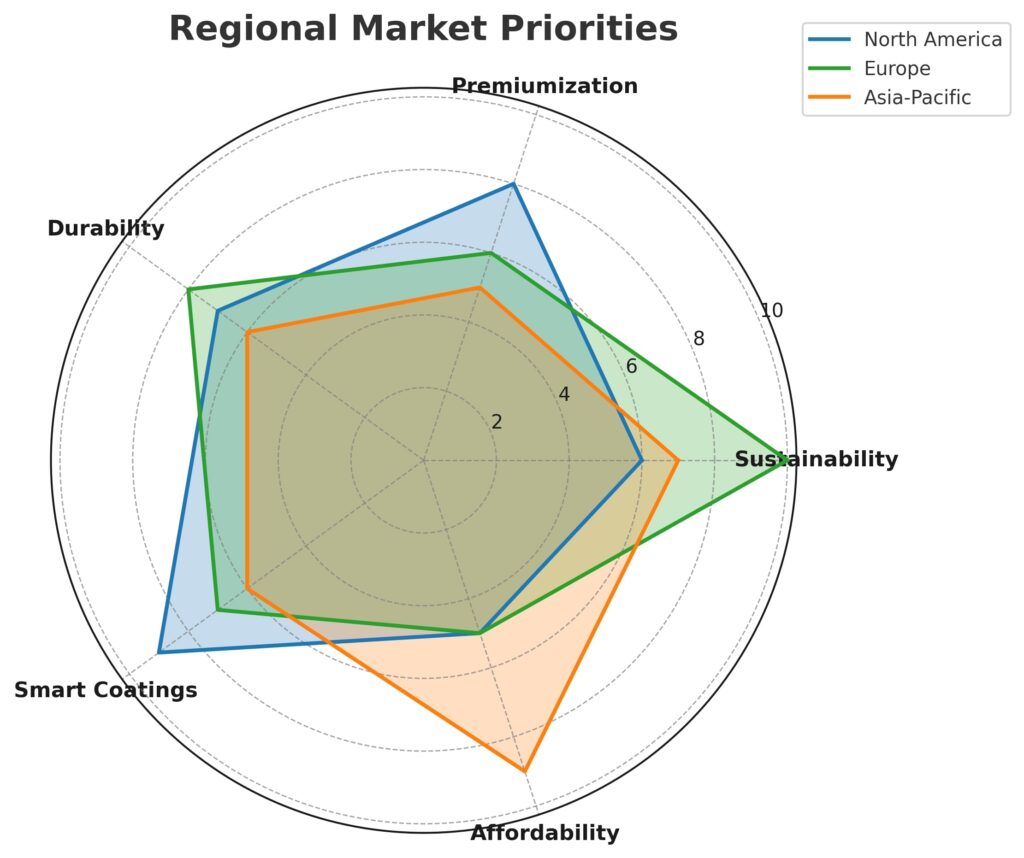

The market is moving in the same general direction, but each region has its own priorities.

The market is moving in the same general direction, but each region has its own priorities.

- North America is led by regulation. Zero-VOC and low-odor paints are the baseline, especially in California, where CARB sets the strictest rules. On top of that, there’s strong demand for washable, antimicrobial interior paints in DIY and premium segments. Here, testing often emphasizes indoor air quality, with ISO 16000 chamber results playing a big role in eco-label approval.

- Europe is even more forward-looking. The EU’s Decopaint Directive and the broader Green Deal framework mean manufacturers must demonstrate not just low VOC, but also carbon footprint, recyclability, and bio-based content. Life Cycle Assessments (LCA) and ISO 14067 carbon footprint studies are now part of market entry, not just nice-to-haves. The focus is on paints that fit into a circular economy.

- Asia-Pacific is the fastest-growing region, and affordability is still king. But at the same time, premium demand in China and India is driving innovation in UV-durable, fungus-resistant, and low-odor paints. Regulations like GB 18582 in China are pushing VOC levels down, while India’s BIS standards are moving closer to EU and US benchmarks. Sustainable fillers especially those derived from industrial by-products, are particularly attractive, because they lower both cost and environmental impact.

Testing and Validation

Testing is central to validating innovations in architectural coating. Beyond aesthetics, coatings are expected to perform in terms of durability, cleanability, and environmental resistance. A comprehensive test matrix ensures coatings meet both regulatory requirements and real-world demands.

| Category | Test / Standard | Purpose |

| Weathering & Lightfastness | QUV Accelerated Weathering

(ASTM G154 / ISO 11507) |

Simulates UV + condensation cycles; checks gloss, color, chalking. |

| Xenon Arc

(ASTM G155 / ISO 11341) |

Simulates full-spectrum sunlight; evaluates color stability of pigments. | |

| Mechanical Durability | Abrasion Resistance – Taber

(ASTM D4060 / ISO 5470) |

Measures weight loss under rotating abrasion; high-traffic areas. |

| Wet Scrub Resistance

(ASTM D2486 / ISO 11998) |

Assesses washable paints under repeated cleaning cycles. | |

| Dry Scrub Resistance | Simulates dry abrasion from repeated contact. | |

| Burnish Resistance

(ASTM D6736) |

Evaluates gloss change in flat/matte paints after rubbing. | |

| Wet Abrasion

(DIN 53778 / EN 13300) |

Tests film removal under wet cleaning cycles. | |

| Chemical & Stain Resistance | Stain Resistance/Removal

(ASTM D4828 / ASTM D3450) |

Assesses resistance to coffee, tea, ink, oil, etc. |

| Alkali Resistance

(ASTM D1308 / ISO 2812-1) |

Ensures durability on cementitious substrates. | |

| Chemical Spot Tests | Checks resistance to cleaners, disinfectants, solvents. | |

| Corrosion Protection | Salt Spray

(ASTM B117) |

Simulates marine/industrial conditions for primers. |

| Kesternich (DIN 50018) | Assesses acid-rain (SO₂) resistance. | |

| Stability & Storage | Heat Aging

(ASTM D1849) |

Simulates long-term storage stability at elevated temperature. |

| Freeze–Thaw

(ASTM D2243) |

Ensures waterborne paints survive repeated freezing cycles. | |

| Moisture Content

(Karl Fischer, ASTM E203) |

Measures trace water in sensitive systems. | |

| Film Formation & Surface | Hiding Power / Contrast Ratio (ASTM D2805 / ISO 6504-3) | Evaluates opacity and TiO₂ efficiency. |

| Gloss Measurement

(ASTM D523 / ISO 2813) |

Measures sheen at multiple angles for consistency. | |

| Hardness (ASTM D3363 Pencil / ASTM D1474 Knoop) | Tests scratch and indentation resistance. | |

| Adhesion

(ASTM D3359 / ISO 2409) |

Assesses film adhesion via cross-hatch or pull-off. | |

| Application Properties | Leveling & Sag

(ASTM D4400 / ASTM D4401) |

Balances smooth film vs sag on verticals. |

| Open Time Measurement | Determines workability window during application. |

Conclusion

Architectural coatings are no longer valued for appearance alone. Their credibility now rests on how well they balance performance, compliance, and sustainability. Advances in resins, fillers, and additives are making it possible to design zero-VOC and low-VOC systems that still deliver durability, washability, and long-term stability. The integration of engineered mineral by-products shows that coatings can lower cost and have an environmental impact at the same time, provided these materials are properly validated.

The future of architectural paints will be shaped by rigorous testing and regional demands. Weathering, abrasion, stain resistance, and storage stability remain the benchmarks that give confidence in new formulations. North America is pushing zero-VOC as a baseline, Europe is tying product acceptance to lifecycle data and circular economy goals, and Asia-Pacific is scaling affordable solutions while embracing durability and low-odor performance. Across these regions, the next generation of coatings will be judged not only by how they look on day one, but by how responsibly and reliably they perform over their lifetime.

References

- Coherent Market Insights. (2025). Architectural coatings market report. Retrieved from https://www.coherentmarketinsights.com/industry-reports/architectural-coatings-market

- Precedence Research. (2025). Architectural coatings market size and forecast 2025–2034. Retrieved from https://www.precedenceresearch.com/architectural-coatings-market

- American Coatings Association. (2024). Key developments in the U.S. architectural coatings market. Retrieved from https://www.paint.org/

- American Coatings Association. (2024). Global trends: Europe & Asia. Retrieved from https://www.paint.org/

- Coatings World. (2024). Renovations and DIY drive growth in architectural coatings market. Retrieved from https://www.coatingsworld.com/

- (2024). Global paint & coatings industry dynamics. Retrieved from https://chemquest.com/

- European Coatings Journal. (2024). Architectural coatings: A market in transformation. Retrieved from https://www.european-coatings.com/

- Data Bridge Market Research. (2023). North America architectural coatings market report. Retrieved from https://www.databridgemarketresearch.com/

- Roots Analysis. (2024). Architectural coatings market forecast 2025–2035. Retrieved from https://www.rootsanalysis.com/

- Grand View Research. (2024). Paints & coatings market analysis. Retrieved from https://www.grandviewresearch.com/

The views, opinions and technical analyses presented here are those of the author or advertiser, and are not necessarily those of ULProspector.com or UL Solutions. The appearance of this content in the UL Prospector Knowledge Center does not constitute an endorsement by UL Solutions or its affiliates.

All content is subject to copyright and may not be reproduced without prior authorization from UL Solutions or the content author.

The content has been made available for informational and educational purposes only. While the editors of this site may verify the accuracy of its content from time to time, we assume no responsibility for errors made by the author, editorial staff or any other contributor.

UL Solutions does not make any representations or warranties with respect to the accuracy, applicability, fitness or completeness of the content. UL Solutions does not warrant the performance, effectiveness or applicability of sites listed or linked to in any content.