by Ron Lewarchik and Vishakha Makode

From the soft pastels that make a home feel warm and welcoming to the tough corrosion-resistant coatings protecting offshore rigs from relentless Sun and waves, paints and coatings are evolving everywhere in our daily lives. Behind the decorative and functional aspects, the industry is also faced with a deluge of new regulations to decrease pollution and protect the environment from hazardous pollutants and chemicals which are slow to degrade (aka forever chemicals such as pfas). Globally, regulations are tightening, pushing for cleaner manufacturing, slashing emissions, eliminating long-lasting hazardous chemicals, and making ingredient lists fully transparent. The vision is the same everywhere, a safer and greener future. The challenge is that each region is taking its own road to get there with different rules, timelines, and priorities. For manufacturers, that means navigating a complex global puzzle while finding ways to meet every requirement without losing the quality and innovation customers expect.

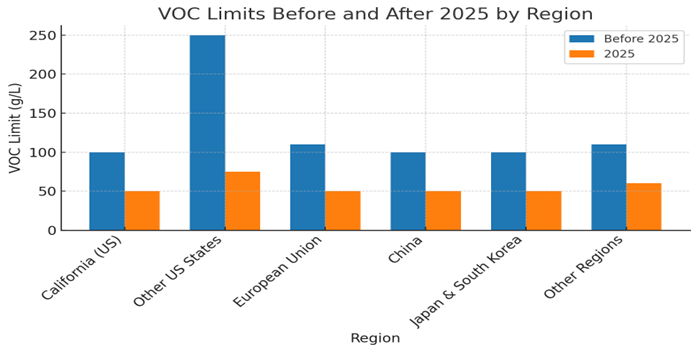

VOC Limits — Same Goal, Different Rulebooks

Volatile Organic Compounds (VOCs) contribute to smog formation and respiratory issues. Global regulators are driving VOC limits down but via differing legal frameworks.

- United States– The U.S. EPA’s January 2025 update to National VOC Emission Standards for Aerosol Coatings introduced new reactivity factors, expanded the list of regulated compounds, and tightened ozone controls. States that hold stronger enforcement levers include: California’s SCAQMD Rule 1113 caps most architectural coatings at under 50 g/L VOC. Other states, including Colorado and Ozone Transport Commission members follow similar benchmarks. Manufacturers often adopt California specs nationwide to streamline production and compliance.

- European Union– The Deco Paint Directive (2004/42/EC), reinforced by REACH chemical regulations, harmonized VOC limits across all member states, accelerating widespread adoption of waterborne and high solids coatings well ahead of other regions.

- Asia– China’s Blue–Sky Action led to national GB standards (2019–2020) cutting VOC thresholds for certain interior paints from 100 g/L to 50 g/L and imposing a 4% consumption tax on products exceeding 420 g/L VOC. Japan and South Korea have VOC regimes closely aligned with EU and U.S. standards, facilitating trade.

Case in point: In regard to VOC, a study by The CMM Group demonstrated that switching from conventional spray guns to electrostatic spray guns improved material transfer efficiency by 30%, significantly reducing VOC emissions and waste without changing formulation

Table 1: VOC Emission Limits: Before and After 2025

| Region | Historical VOC Limits (Before 2025) | Current VOC Limits (2025) | Notes and Milestones |

| California (US) | ~100 g/L (early 2000s, initial SCAQMD Rule 1113 baseline) | 50 g/L (SCAQMD Rule 1113 since ~2019) | California progressively tightened VOC limits; remains the most stringent U.S. benchmark |

| Other US States | Varied widely, typically 100–250 g/L federally | 50–100 g/L, many aligning near California | EPA’s federal limits started higher (~250 g/L in late 90s); states increasingly adopt stricter levels |

| European Union | Varies pre-2004; often above 100 g/L | ~50 g/L (Deco-Paint Directive 2004/42/EC) | Harmonized VOC limits since 2004; supported by REACH regulations across all member states |

| China | ~100 g/L or higher pre-2018 | 50 g/L (GB standards 2019–2020) | “Blue Sky Action” implemented tighter national standards, plus a 4% tax on >420 g/L VOC products |

| Japan and South Korea | Approximately 100 g/L pre-2010s | ~50 g/L, aligned with EU and U.S. standards | Harmonization with OECD guidelines facilitates compliance and trade |

| Other Regions | Mostly >100 g/L or variable | Varies widely; many emerging regulations | Regulatory frameworks in emerging markets are evolving in step with global environmental priorities |

PFAS — From Star Performer to Sunset Chemical

PFAS, prized for their oleophobic and hydrophobic properties, persist in the environment and bioaccumulate, leading to broad regulatory phase-outs.

- United States– The EPA’s TSCA PFAS (per and polyfluoroalkyl substances) Reporting Rule mandates disclosure of all uses since 2011, including imports. States lead with bans: Maine aims for near-total bans by 2030; Minnesota and Washington by 2032; California and Colorado are focusing on sector-specific bans.

- European Union– In 2023, five member states proposed to ECHA a REACH restriction covering over 10,000 PFAS substances, with most phase-outs expected between 2025 and 2027, though narrow exemptions apply.

- Asia– Japan and South Korea restrict certain long-chain PFAS; China is actively evaluating national controls.

Microplastics — Early Action in the EU

- European Union– Commission Regulation (EU) 2023/2055, effective October 2023, bans intentionally added microplastics exceeding 0.01% w/w in many products including some decorative paints. Loose glitter is banned immediately, with phased transition periods for other uses.

- United States– No federal microplastics regulations in coatings exist yet; California and New York are researching emissions from road-marking and marine paints.

- Asia – Microplastics regulation remains in research and developmental stages.

Work smarter and win more, with powerful software to manage regulatory, supply chain and sustainability challenges, learn more about ULTRUS here!

Ingredient Transparency — From Obligation to Value Proposition

- United States– OSHA’s Hazard Communication Standard governs Safety Data Sheets; California’s Proposition 65 mandates warnings for toxicants; Maine requires public PFAS use reporting.

- European Union– REACH requires disclosure of Substances of Very High Concern (SVHC) if present above 0.1% w/w. The forthcoming Digital Product Passport will increase visibility and supply chain accessibility.

- Asia– Japan and South Korea follow GHS-based hazard communication; China’s 2020 GB VOC standards list prohibited solvents, requiring careful formulation audits.

Sustainability & Circular Economy: Closing the Loop

- European Union– The Circular Economy Action Plan and Packaging & Packaging Waste Regulation (2023) require recyclability, set mandatory recycled content thresholds, and impose Extended Producer Responsibility (EPR) schemes on paint packaging and leftover paint.

- United States– PaintCare programs cover 11 states plus D.C., recycling millions of gallons annually; voluntary programs such as Safer Choice and Environmental Product Declarations (EPDs) bolster greener product procurement.

- Asia– Japan enforces container recycling schemes; China pilots leftover paint collections and promotes high-transfer-efficiency spray equipment; India is advancing lifecycle-based product regulation.

Industry case study: Anguil Environmental’s project with an automotive supplier installed an emissions concentrator and thermal oxidizer, reducing VOC treatment airflows by 15×, cutting operational costs and enhancing sustainability compliance

Market and Regulatory Interaction Effect:

- Formulation Changes: Substituting raw materials to manage tariff impacts often triggers new safety data submissions, REACH notifications, or U.S. TSCA inventory checks.

- Cost Pass-Through: Rising input costs and compliance burdens are increasingly embedded in end-product pricing, particularly in industrial and OEM coatings with thin margins.

- Supply Diversification: Multinational manufacturers are building regional redundancy – sourcing pigments, resins, and additives from multiple jurisdictions to avoid dependence on one tariff-exposed market.

- Compliance Bottlenecks: When sourcing shifts to non-traditional suppliers, verifying compliance with VOC, PFAS, and heavy metal limits can delay product launch schedules.

Overview of 2025 Coatings Regulatory Requirements:

After looking at how different regions are reshaping regulations for the coatings industry, the path to compliance is far from uniform. The direction is similar toward cleaner products, safer chemistry, and greater transparency, yet the limits, timelines, and documentation requirements still vary from one market to another. For global manufacturers, this creates a constant balancing act between satisfying local rules and keeping product performance consistent. To bring these developments together, Table 2 provides a consolidated view of the main 2025 coatings regulations in major regions. It offers and at a glance reference that connects the trends discussed in this article with the actual rules and deadlines that will guide market strategies in the year ahead.

Table 2: Coatings Regulatory Requirements (2025)

| Regulatory Topic | United States (US) | European Union (EU) | Asia (China, Japan, South Korea, India) |

| VOC Limits | EPA amended aerosol coatings VOC limits (Jan 2025). CA Rule 1113 <50 g/L. OTC & CO follow. | Deco-Paint Directive 2004/42/EC harmonized strict limits. | China: 50 g/L for some; >420 g/L taxed 4%. JP/KR align with EU/US. |

| PFAS | State bans: ME 2030, MN/WA 2030–2032, CA/CO sector bans; TSCA PFAS reporting since 2011. | REACH restriction >10,000 PFAS; phase-out 2025–2027; POPs ban PFOA. | JP/KR restrict long-chain PFAS; China reviewing controls. |

| Microplastics | No federal ban; CA & NY research underway. | (EU) 2023/2055 bans >0.01% w/w intentionally added microplastics. | No binding laws; research ongoing. |

| Transparency | OSHA SDS; Prop 65 warnings; ME PFAS public reporting. | REACH SVHC >0.1% disclosure; Digital Product Passport pending. | JP/KR GHS; China’s prohibited solvent lists in VOC rules. |

| Sustainability | Paint Care in 11 states + D.C.; Safer Choice & EPDs. | Circular Economy Action Plan; Packaging Waste Reg; EPR schemes. | JP container recycling; China pilot paint recovery India lifecycle |

In Summary:

The global coatings industry is undergoing one of the most significant regulatory shifts in its history. From low-VOC decorative paints to high-performance protective coatings for offshore infrastructure with every segment being reshaped by new environmental and safety rules. Governments worldwide are aligning common objectives such as cutting harmful emissions, eliminating persistent chemicals like PFAS, ensuring ingredient transparency, and supporting circular economy principles.

While the end goals are similar, the regulatory paths and timelines vary widely across regions. The United States, European Union, and Asia-Pacific each have distinct compliance frameworks and thresholds. These differences create both challenges and opportunities. Companies that adapt quickly, reformulate sustainably, and integrate compliance into their innovation strategies are positioned to gain market advantage, while those that lag risk higher costs, restricted market access, and loss of competitiveness.

References

- S. EPA, Final Rule: Aerosol Coatings National VOC Emission Standards, Jan 6, 2025.

- S. EPA, National VOC Emission Standards for Aerosol Coatings Interim Final Rule, July 2, 2025, Federal Register.

- PaintCare, Annual Report on Paint Stewardship Programs, 2024.

https://www.paintcare.org/wp-content/uploads/docs/dc-annual-report-2024.pdf

- PCI Magazine, Regulatory Challenges and Compliance in the Global Coatings Market, Aug 2025.

- SGS SafeGuardS, VOC Coating Standards and Consumption Tax – China, 2020.

- Environmental Law Institute, Forecast for Chemical Regulatory Policy 2025 Including PFAS, Mar 2025.

- European Union, Directive 2004/42/EC on VOC Limits in Paints and Varnishes.

https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX%3A32004L0042

- European Union, Commission Regulation (EU) 2023/2055 on Microplastics Restrictions.

https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX%3A32023R2055

- State of Maine, An Act to Prevent PFAS Pollution, 2023.

- OSHA, Hazard Communication Standard.

- California OEHHA, Proposition 65.

https://www.p65warnings.ca.gov

- Japan MOE / Korea MOE, GHS Chemical Safety Rules.

https://www.totalsds.com/ghs-in-asia-china-korea-and-japan/

- China Standardization Administration, VOC Limits for Coatings, 2020.

- S. EPA, TSCA PFAS Reporting Rule, 2023.

- ECHA, PFAS REACH Restriction Proposal, 2023.

https://www.sgs.com/en-us/news/2023/02/safeguards-2023-echa-issues-restriction-proposal-for-pfas

- The CMM Group, Reducing VOC Emissions from Paint & Coatings Applications.

https://www.thecmmgroup.com/reduce-voc-emissions-paints-coatings/

- Anguil Environmental Systems, Case Study: Emissions Abatement for Automotive Paint Booth Overspray, 2020. (Indirect link from company case study page)

https://anguil.com/case-studies/paint-booth-over-spray/

The views, opinions and technical analyses presented here are those of the author or advertiser, and are not necessarily those of ULProspector.com or UL Solutions. The appearance of this content in the UL Prospector Knowledge Center does not constitute an endorsement by UL Solutions or its affiliates.

All content is subject to copyright and may not be reproduced without prior authorization from UL Solutions or the content author.

The content has been made available for informational and educational purposes only. While the editors of this site may verify the accuracy of its content from time to time, we assume no responsibility for errors made by the author, editorial staff or any other contributor.

UL Solutions does not make any representations or warranties with respect to the accuracy, applicability, fitness or completeness of the content. UL Solutions does not warrant the performance, effectiveness or applicability of sites listed or linked to in any content.