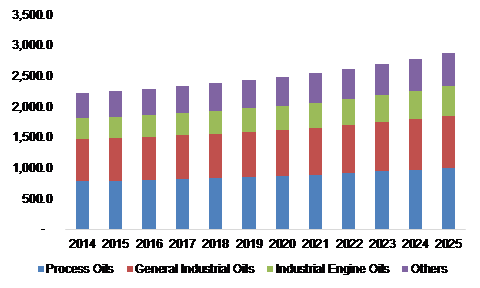

The global industrial lubricants market recorded demand generation of 15,017 kilotons in 2015 and is projected to rise to 19,477.6 kilotons by 2024. Industrial lubricants are typically used to minimize friction between adjacent components, reducing loss resulting from wear and tear. Lube oil usage is of significant importance today due to growth of end-use industries across the globe. Industrial lubricants are in high demand from textile finishing industries, especially across Asia Pacific. Among the multiple industrial lubricants, engine oils emerged as the fastest growing product due to its heavy demand across North America and Europe, among others. The demand is poised to create growth opportunities for formulators in the global market for industrial lubricants.

The global industrial lubricants market recorded demand generation of 15,017 kilotons in 2015 and is projected to rise to 19,477.6 kilotons by 2024. Industrial lubricants are typically used to minimize friction between adjacent components, reducing loss resulting from wear and tear. Lube oil usage is of significant importance today due to growth of end-use industries across the globe. Industrial lubricants are in high demand from textile finishing industries, especially across Asia Pacific. Among the multiple industrial lubricants, engine oils emerged as the fastest growing product due to its heavy demand across North America and Europe, among others. The demand is poised to create growth opportunities for formulators in the global market for industrial lubricants.

Need sustainable lubricants?

UL Prospector® has listings for biodegradable materials from global suppliers. Find technical data, request samples, and contact suppliers with Prospector.

Search biodegradable lubricants now

Top trends in the industrial lubricants market

Two factors are expected to be the driving force for industrial lubricants growth: the importance of smooth functioning of the machinery and the prevention of equipment failure owing to lack of lubricity and excess friction. The growth of manufacturing units around the world has a direct impact on the consumption of industrial lubricants.

#1 Emergence of bio-based lubricants as a sustainable alternatives

Eco-friendly industrial lubricants has been a niche trend, but now these alternatives, extracted from vegetable oils, are observed to be growing significantly as a strategic attempt to minimize environmental pollution. Sources of concern include significant losses of lubricants into water-bodies by marine vessels, as well as leakage and spillage into roadways. Although bio-based lubricants comprise only a small fraction of the total industry today, the growing awareness about environmental protection and awareness among formulators and end-users are projected to increase demand for bio-based counterparts in the near future.

#2 Innovations in low-viscosity lubricants segment

At low temperature, low viscosity lubricants enhance an engine’s performance by improving on ignition as well as consumption of less fuel. Selecting an oil for certain engine types depends on the viscosity of the lubricants. Multiple transportation companies prefer using low-viscosity lubricants, due to lesser flow resistance, which reduce friction and energy losses more than typical synthetic lubricants. This improves engine’s life and performance. Apart from automobile applications, these lubricants are also preferred for wind turbine applications for comparatively smoother functioning of bearings in massive gear shifter components.

#3 Emergence of advanced food grade lubricants

Lubricants demand in the food processing industry is estimated to grow due to three significant industry drivers, which includes a switch towards automatic lubrication systems, a shift towards smart factories, and low crude oil prices. Producers in the industry prefer automatic lubrication systems as they keep the required components lubricated at regular set intervals. Food processing techniques have evolved from traditionally man-powered to process automation, which uses more food-grade lubricants. Although multiple regulatory frameworks scrutinize the industry, the lubricant demand is projected to grow significantly due to the aforementioned changes.

#4 Rapidly growing industrialization in BRIC nations

The growth across Brazil, Russia, India, and China (BRIC nations) has been notable in the past five years, with China accounting for around 43.9 percent of the overall GDP in 2013. Demand for industrial lubricants in energy, agriculture, chemicals, steel and other sectors drive growth. Industrial production in other markets such as Brazil, Russia, and India was USD 498.81 billion, USD 512.31 billion, and USD 470.29 billion in 2013 respectively. Following China, industrial production in India witnessed growth at 3.2 percent in 2015. Industrial output in India stood at 25.8 percent of GDP in 2013. Industrial output in all of BRICS was USD 4,046.71 billion in 2008 and it grew to USD 5,598.81 billion by 2013. Also, the economic block is improving upon niche segments such as 3D printing and medical sectors, wherein the medical sector reflects majority of the demand.

What the future holds: Market overview

As per Grand View Research, the global industrial lubricants market shall evolve concurrently with the growth of end-use industries such as electronics, chemical manufacturing, and food processing among others, especially in Asia Pacific. The major demand is generated from machinery cost-stabilizing aspects coupled with decreasing maintenance downtime as well as improving functional efficiency of machines.

Key industry participants such as ExxonMobil Corporation, Fuchs Group, Lubrizol Corporation, Royal Dutch Shell and more are investing heftily in research and development activities to formulate new product lines to meet growing demand from niche markets.

Further reading:

- Fluid Dynamics and the Theory of Everything

- Food for Thought: Food-Grade Lubricants and Their Regulation

- Grease chemistry: Thickener structure

About the Author:

Harsha Jandhyala currently works as a Team Lead at Grand View Research in the chemicals team. His primary focus is on assessing new market opportunities, analysing governmental and regulatory policies, market sizing & forecasts. He has expertise in various industries that include specialty chemicals, renewable chemicals, and polymers.

Harsha Jandhyala currently works as a Team Lead at Grand View Research in the chemicals team. His primary focus is on assessing new market opportunities, analysing governmental and regulatory policies, market sizing & forecasts. He has expertise in various industries that include specialty chemicals, renewable chemicals, and polymers.

With five years of experience in market research, business intelligence, consulting and strategy building. Harsha began his career as a structural engineer, before being promoted to the position of project manager with various construction companies. Later on, his career guided him to the chemicals and materials sector, where he worked as a strategic consultant.

The views, opinions and technical analyses presented here are those of the author or advertiser, and are not necessarily those of ULProspector.com or UL Solutions. The appearance of this content in the UL Prospector Knowledge Center does not constitute an endorsement by UL Solutions or its affiliates.

All content is subject to copyright and may not be reproduced without prior authorization from UL Solutions or the content author.

The content has been made available for informational and educational purposes only. While the editors of this site may verify the accuracy of its content from time to time, we assume no responsibility for errors made by the author, editorial staff or any other contributor.

UL Solutions does not make any representations or warranties with respect to the accuracy, applicability, fitness or completeness of the content. UL Solutions does not warrant the performance, effectiveness or applicability of sites listed or linked to in any content.

Tha,ks for your very interressting informations.

Regards

Daniel

very interesting and informative article, thanks for sharing this.